- Home

- Employee Retention Credits

Employee Retention Credits

The Employee Retention Tax Credit (ERC) is a powerful incentive program designed to reward businesses for keeping employees on their payroll during the challenging times of COVID-19.

Don’t miss out on this incredible opportunity to strengthen your business for supporting your employees and community during the pandemic.

We Help Small Businesses get up to $28K per employee on tax credit refunds. We specialize in qualifying, maximizing, and claiming ERC funding for small business owners.

What our best Employee Retention Credits Services

We will sort through and scrub your payroll documents (941s) to maximize your credits, amend your tax forms, and provide audit protection.

Still need help with COVID? Relief funds are here for small businesses. Apply now to keep your business going strong.

If your company employs 2-500 workers with W-2 forms, you could be eligible for stimulus funds!

1. The CARES Act (2020)

In response to the pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted in March 2020. This groundbreaking law pioneered the implementation of the Employee Retention Credit, serving as a vital support system for small businesses facing challenges in maintaining their workforce amidst lockdowns and economic downturns.

The CARES Act allowed eligible employers to receive a refundable tax credit equal to 50% of qualified wages up to $10,000 per employee.

The Consolidated Appropriations Act (2021)

Building on the foundation of the CARES Act, this legislation, passed in December 2020, extended and expanded the ERC to provide further relief to businesses. The credit amount was increased to 70% of qualified wages, and the eligibility criteria were expanded to encompass businesses that experienced significant revenue declines.

The American Rescue Plan Act (2021)

Enacted in March 2021, this act extended the ERC yet again, enhancing its benefits for small businesses. Expanding the credit accessibility to encompass the entirety of 2021, this adjustment broadens its relevance for an extended period of employee retention.

Additionally, the credit percentage remained at 70% of qualified wages, but the maximum creditable wage per employee was increased to $10,000 per quarter.

ERC Easily Explained in Video

“Between 70% to 80% of small and medium-sized businesses, along with tens of thousands of charities, were eligible for the ERC.”

The truth is, the current number of businesses and charities applying for the ERC is much lower than expected.

Billions of dollars are slipping through the fingers of small and medium businesses, along with tax-exempt organizations and charities. The misconception among business owners and charity managers is that the Employee Retention Credit (ERC) is exclusively intended for entities experiencing distress or financial hardship.

“Congress saw this provision as a way to encourage businesses and charities to keep and hire employees, helping them navigate through the economic challenges and costs caused by Covid.”

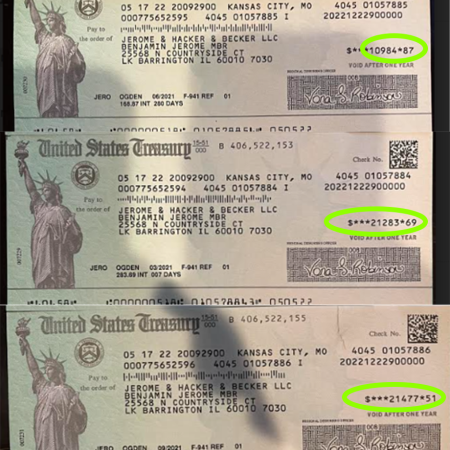

How much have our businesses received?

Business 1

Retail shop in the mall

9 employees

ERC Credit: $68,000

Business 2

Local Restaurant (5 locations)

63 employees

ERC Credit: $1,200,000

Business 3

Local Catering Company

15 employees

ERC Credit: $262,500

Business 4

Trucking Company (Interstate - 20 locations)

180 employees

ERC Credit: $3,100,000

Can qualify up to $28,000 per

W-2 employee.

We’re averaging almost $18,000 per

W-2 employee.

Up to this point, our typical enterprise has been generating around $225,000 on average.

If you think that you don’t qualify, have been told by your accountant or CPA that you don’t qualify, or simply think it’s too good to be true, what would it hurt to let us try?

You won’t pay us until you get paid!