Investment Education

Investments come in a wide variety of forms, each with its own characteristics, risks, and potential returns.

(Note: Below listed investments may or not be offered and are provided for educational purposes and are not considered recommendations.)

Types of Investments:

1. Stocks (Equities)

- Common Stocks: Shares that represent ownership in a company, giving shareholders voting rights and a share in profits through dividends.

- Preferred Stocks: Shares that provide a fixed dividend but usually don’t come with voting rights.

2. Bonds (Fixed Income)

- Government Bonds: Issued by governments; considered low-risk.

- Corporate Bonds: Issued by companies; higher risk than government bonds.

- Municipal Bonds: Issued by local governments; often tax-exempt.

- Treasury Bonds: Long-term bonds issued by the U.S. government.

- Junk Bonds: High-yield, high-risk bonds from companies with lower credit ratings.

3. Mutual Funds

- Equity Funds: Invest in stocks.

- Bond Funds: Invest in bonds.

- Index Funds: Track specific market indexes.

- Balanced Funds: Invest in a mix of stocks and bonds.

4. Exchange-Traded Funds (ETFs)

- Stock ETFs: Track a stock index.

- Bond ETFs: Track a bond index.

- Sector ETFs: Focus on specific sectors like technology or healthcare.

5. Real Estate

- Direct Real Estate Investment: Buying physical properties.

- Real Estate Investment Trusts (REITs): Companies that own and operate income-producing real estate.

6. Commodities

- Precious Metals: Gold, silver, platinum.

- Energy: Oil, natural gas.

- Agricultural Products: Wheat, corn, soybeans.

7. Derivatives

- Options: Contracts that give the right, but not the obligation, to buy or sell an asset at a set price.

- Futures: Contracts to buy or sell an asset at a future date for a predetermined price.

- Swaps: Contracts to exchange cash flows or other financial instruments

8. Cryptocurrencies

- Bitcoin: The first and most widely known cryptocurrency.

- Ethereum: A cryptocurrency with smart contract functionality.

- Altcoins: Other cryptocurrencies like Ripple, Litecoin, and Cardano.

9. Certificates of Deposit (CDs)

- Short-term CDs: Typically mature in less than a year.

- Long-term CDs: Maturities can range from one year to several years.

10. Savings Accounts

- High-Yield Savings Accounts: Offer higher interest rates than traditional savings accounts.

11. Annuities

- Fixed Annuities: Provide regular, guaranteed payments.

- Variable Annuities: Payments depend on the performance of investment options chosen by the holder.

12. Collectibles and Alternative Investments

- Art: Paintings, sculptures.

- Antiques: Furniture, historical artifacts.

- Wine: Investment-grade wines.

- Other Collectibles: Coins, stamps, sports memorabilia.

13. Private Equity and Venture Capital

- Private Equity: Investing in private companies.

- Venture Capital: Investing in early-stage, high-potential companies.

14. Hedge Funds

- Market-Neutral Funds: Aim to offset market risk by taking long and short positions.

- Event-Driven Funds: Invest based on corporate events like mergers and acquisitions.

15. Money Market Instruments

- Treasury Bills (T-Bills): Short-term government securities.

- Commercial Paper: Short-term unsecured promissory notes issued by corporations.

- Certificates of Deposit (CDs): Short-term CDs issued by banks.

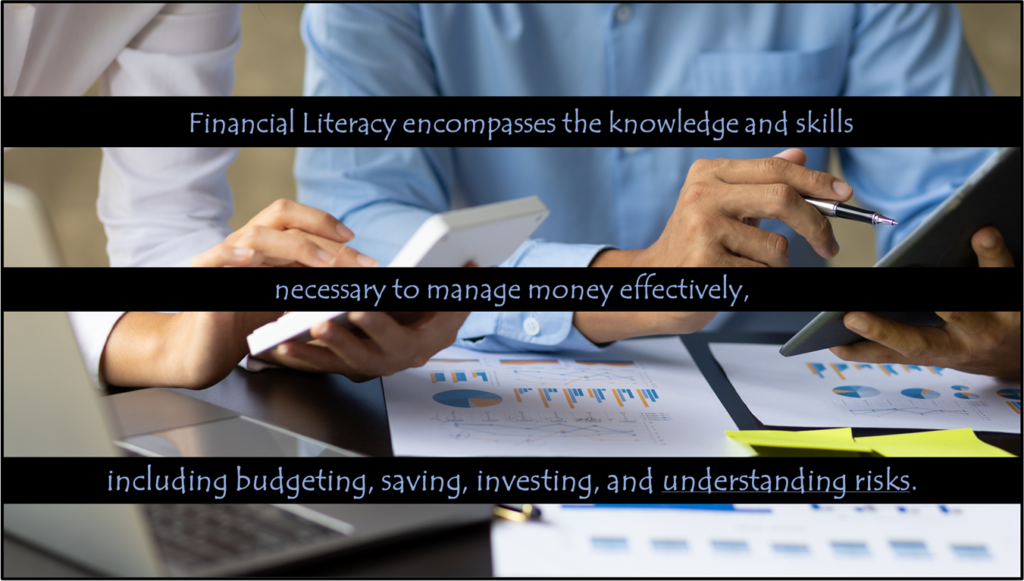

Each type of investment has its own set of characteristics and is suitable for different investor needs and risk tolerance levels. Diversifying across multiple types can help manage risk and improve the potential for returns, but it is important to understand the risk factors of each investment before entering any investment. Understanding how money works is more than just numbers—it’s empowerment. A strong grasp of financial basics helps individuals make better decisions about spending, saving, and investing. In cities like Tyler and Dallas, where living costs can fluctuate, financial literacy gives people the tools to thrive, not just survive.

It also helps you spot risk, ask the right questions, and plan confidently for the future. With better knowledge, you can avoid debt traps, prepare for emergencies, and grow your wealth with purpose. This is exactly what Plush Retirement is committed to—educating individuals and families across Texas through accessible, easy-to-understand guidance from experienced professionals like your trusted Financial Advisor or Personal finance advisor.

Major Investments Risk Spectrum

The higher the risk, the higher chance for potential gains, but so is the risk of loss! Finding the right solution or balance can be challenging, so make sure that you increase your knowledge through financial education & find a trusted advisor to get the proper guidance and education.

"Compound Interest is the 8th Wonder of the World

Those who understand it, EARN IT,

Those who don’t, PAY IT !"

- Albert Einstein

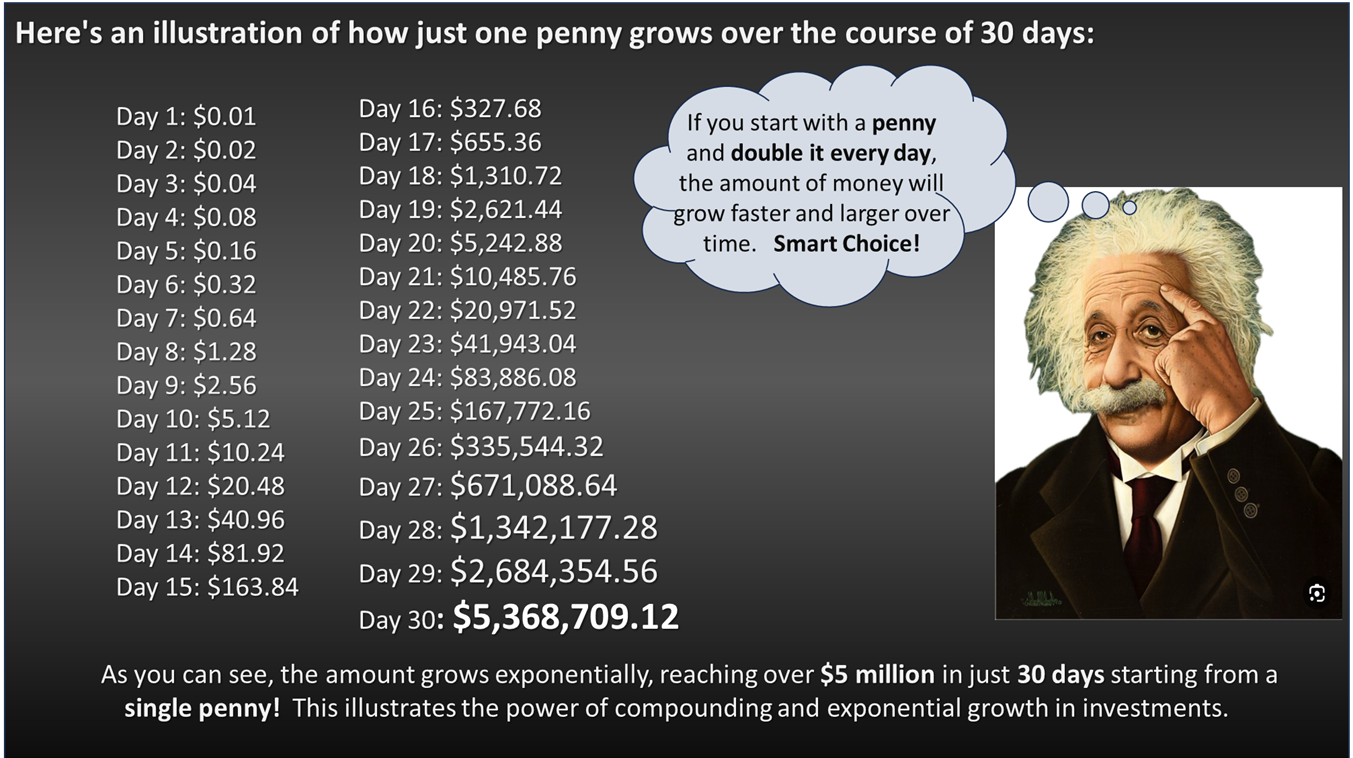

In the Rule of 72 we can see how long it will take to double our investments, depending on the interest rate. Now, let’s see if you get the concept.

If you were given the choice of:

1.) One million dollars in silver

or

2.) One penny that you would double every day for a month (30 days) and keep all the change after day 30……

Which would you pick??

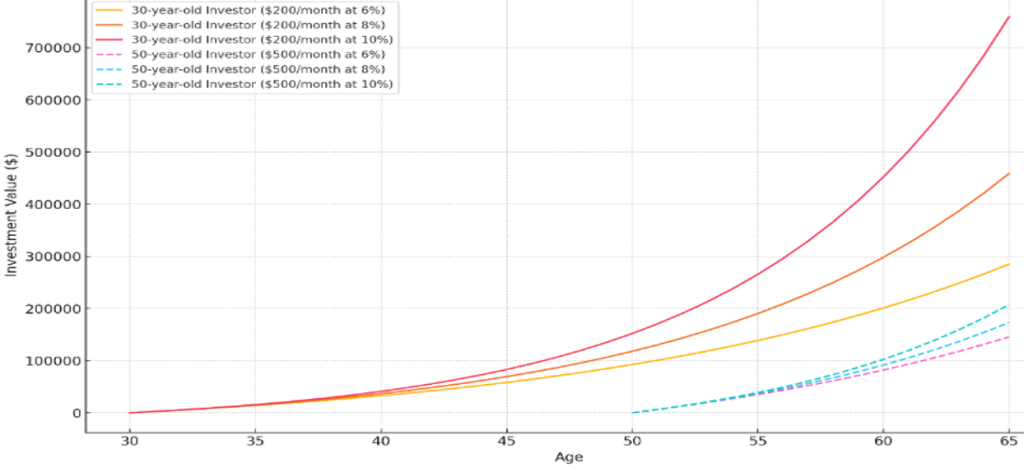

The following graph illustrates the investment growth comparison at the different returned interest rates of 6%, 8%, & 10% .

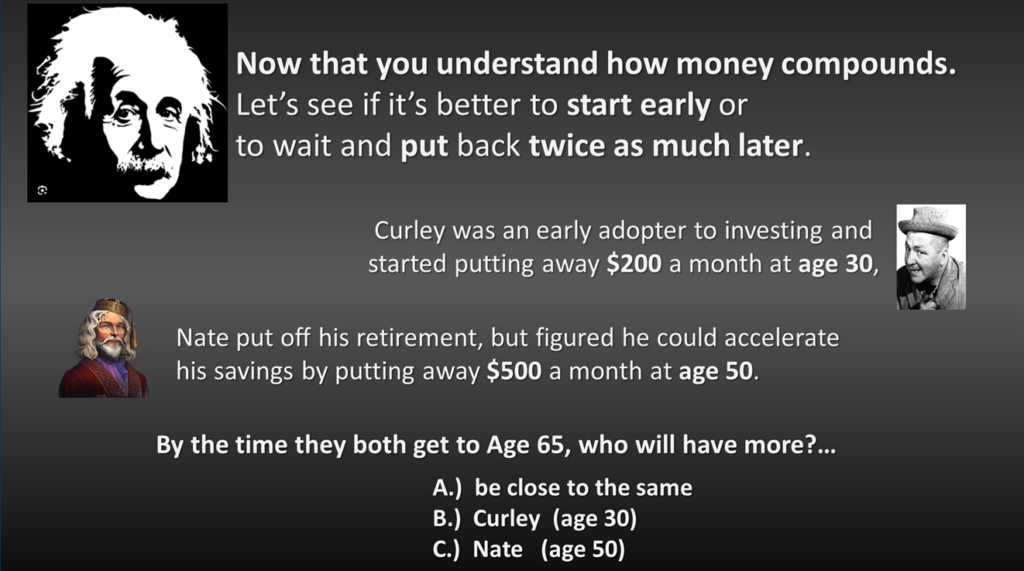

As we learned in the Rule of 72, the longer time you have, the more time your money has to double/compound.

As we get older, we simply run out of time.

So, it’s better to start Early like Curley, Instead of Late like Nate!!

The important thing is that you are now thinking about your finances. Whether silly or not, it is important to give your finances more than a second thought. The more you understand and educate yourself, the better your relationship with money will be.

It won’t always be fun, but those who plan will be happier, live longer, and have a much better and enjoyable life,

as well as retirement !