1. Derogatory G High-Interest Debt– Buying anything on credit that doesn’t make you money or generate cash flow is keeping you from generating The only way to break the chains of financial enslavement is to break your spending habits. If you maintain credit card balances, you are making interest payments instead of receiving interest on your money. So, if you have a credit card with 21% and have ten thousand dollars in debt, you are paying $175 a month without paying a penny towards your principal. That’s more than your satellite or cable bill!

Important Note: If debt allows you to attain assets that generate more money, then it isn’t derogatory.

2. Late Payments or the Credit Limit Fees

These are a complete waste of your money! Credit card and financial companies will allow you to go above your credit They are happy to charge you an extra fee for being one penny above your credit limit or being one day late (not thirty). Credit Card providers are currently charging anywhere from $25 to $85 in late and over the credit fees and will very rarely reverse these fees. Statistics show that most payments are made within five to ten days after the payment due date. A simple week’s worth of budgeting can eliminate these hazardous charges. If you are paying money on late fees, that’s less money that could have been used to pay off your debt.

3. Improper ROI Vehicles or paying too much in Management Fees –

Many people think that putting money in the bank is the logical thing to do, but have you looked at what savings accounts are paying nowadays? Even CD or treasury bonds aren’t competing with If you had $100 stuffed under the mattress or buried in the backyard on January 1, 2023, then it would have only been worth $92 on January 1, 2024 due to inflation. If you aren’t outpacing inflation, then you better start saving twice as much.

Two other factors that affect ROI are losing money in risky investments like stocks, mutual funds, or equities and paying too much in fees. Research has shown that most 401ks and IRA owners would have thirty to forty percent more in retirement had they not paid the 1-2% annual fees typically charged by their 401K custodians or financial advisors.

4. Unemployed Money or Lazy Money – What’s worse than low ROI or Return on Investment? How about NO ROI? If you have money at your disposal and you are not using it to make more money, then you may need a paradigm In 2023 the average bank account interest rate was still below 2%, yet inflation reached upward to 8%. If you have money buried in the back yard or mattress money, then you are going broke slowly!

We often hear people say they don’t ever have any extra money to invest. Consider this before you buy a brand- new vehicle. What if you waited four or five years and invested those payments in something that will make you money? Then, you can start to earn off your money, instead of constantly paying it. Is your money working for or against you?

5. Spontaneous, Frivolous, and Unnecessary Expenditures – This is huge!

There’s a reason that marketers strategically place items near the check out line in hopes of luring last minute impromptu purchases. If you didn’t need it before you were there, be cognizant of what last minute purchase may leave in your shopping bag. How about the temptation of discounts or sales? My wife often comes back excited that she saved $40 at the store shopping, but seldom can tell me how much she spent. Oh, the temptation of a bargain! If you are tempted by garage sales, eBay, or Amazon, chances are that you are probably spending money on things that you don’t need, simply because they are on sale or cheap. Resist the urge!

6. Lack of Emergency Funds or Unplanned Events –

Maybe, you’re doing great and have some higher yielding investments. But have you left yourself enough for emergencies? Many higher-yielding investments have early surrender or termination fees that could be costly or worse yet, imagine having to borrow money from a credit card to pay for an unseen event like a flooded home, an emergency medical procedure, or the need for a new central HVAC system. Life happens. If you aren’t prepared for a small event, how will you survive a major one? It’s great to have your money working for you, but make sure you have a portion available in case the unforeseen or unmentionable happens. Many types of insurance will also protect you from unforeseen catastrophes.

7. Financial Mindset/Discipline – Unfortunately, most people lack the intestinal fortitude to discipline their spending habits, especially when it comes to credit card spending.” I work hard, so want to go on ” ”I deserve to drive a nice car, and buy nice clothes.” ” I only pamper myself with a coffee and pastry in the mornings.” –

But at whose expense? …… Yours!

If you want to change your trajectory, you’ll have to reset your thinking and logic. If it’s not making you money, then it is costing you money! When you purchase things that don’t make you money or worse, cost you money, you fall further and further behind.

Advise: If you find yourself wanting to buy any big-ticket items, then put it on a waiting list. If you still want it after 90 days, then go ahead and buy it. You will be surprised that most items lose their luster after just 30 days and will reduce spontaneous spending.

Conclusion:

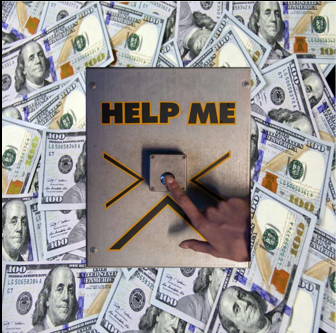

Is instant gratification causing you to accept the shackles of financial slavery, countless hours of employment, indebtedness, and continued stress? If you find yourself just getting by, imagine how your retirement is going to look. Instead of finding yourself bitter and unable to get by in your golden years, are you willing to take a page from the wealthy’s playbook and train your brain?

If you can flip the switch and use your money for you, as opposed to against you, you can start the journey to financial independence.

Chances are, if it’s not making you money, then it’s costing you money or time. There’s still time to maintain your financial independence and stay in control of your retirement. Just having the discipline to practice better habits and make small sacrifices can be instrumental in maintaining control of your retirement and financial independence.

Now that you know what’s been keeping you from financial freedom, do you have the desire and determination to change it?

If you would like some additional help, education, or guidance, feel free to reach out to one of our advisors.

“You can have a bad or average retirement. You can have a good retirement.

Or

You can have a Plush Retirement!”