Tax-Free Retirement

Sarah, prudent in her financial foresight, opted for a Roth IRA early in her career. As she embarks on retirement, she relishes the freedom afforded by tax-free withdrawals. Unencumbered by tax liabilities, she navigates her twilight years with peace of mind, knowing her nest egg remains intact, shielded from the ravages of taxation

Now let's look at Emily, who discovered the unparalleled advantages of an IUL policy. By harnessing the power of tax-deferred growth and market-linked returns, Emily's policy accumulates cash value over time, shielded from taxation. In retirement, she orchestrates a symphony of tax-free withdrawals, deriving income from her policy's cash value without triggering tax liabilities.

Which Type of Plan is Right for You??

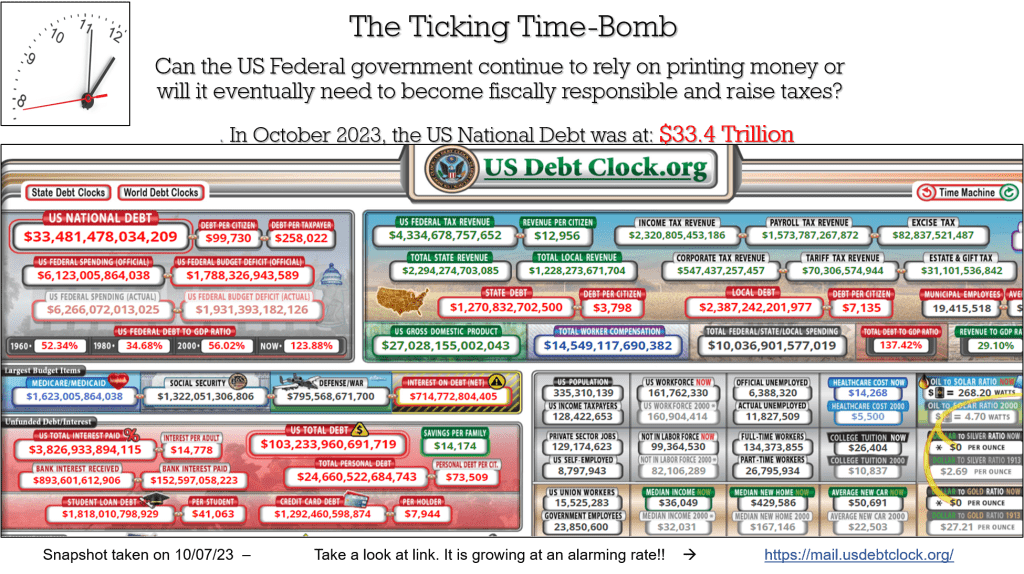

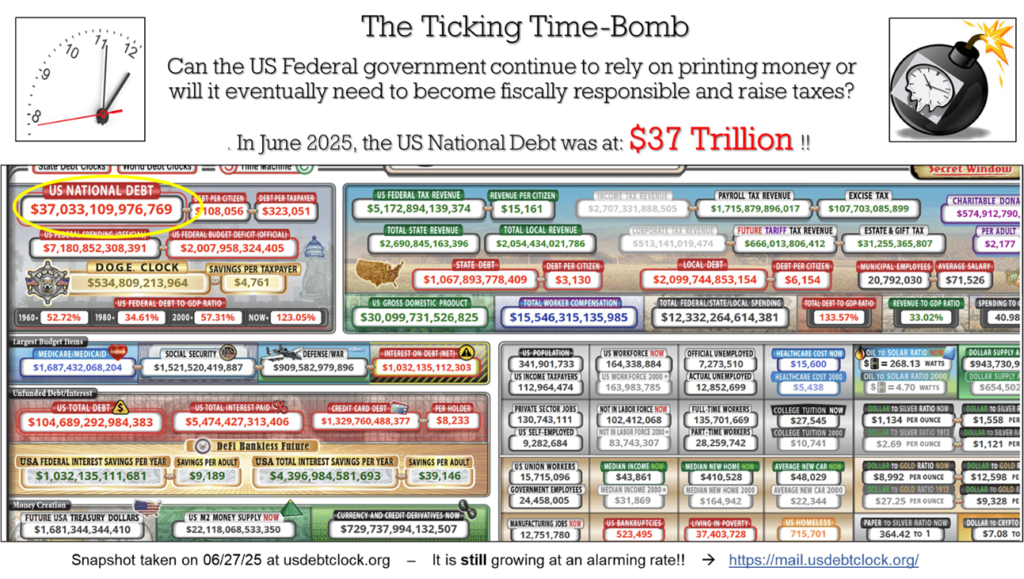

Do you think that the Federal Income

Taxes will be…..

….going up or going down?

DO YOU WANT TO PAY THOSE TAXES?

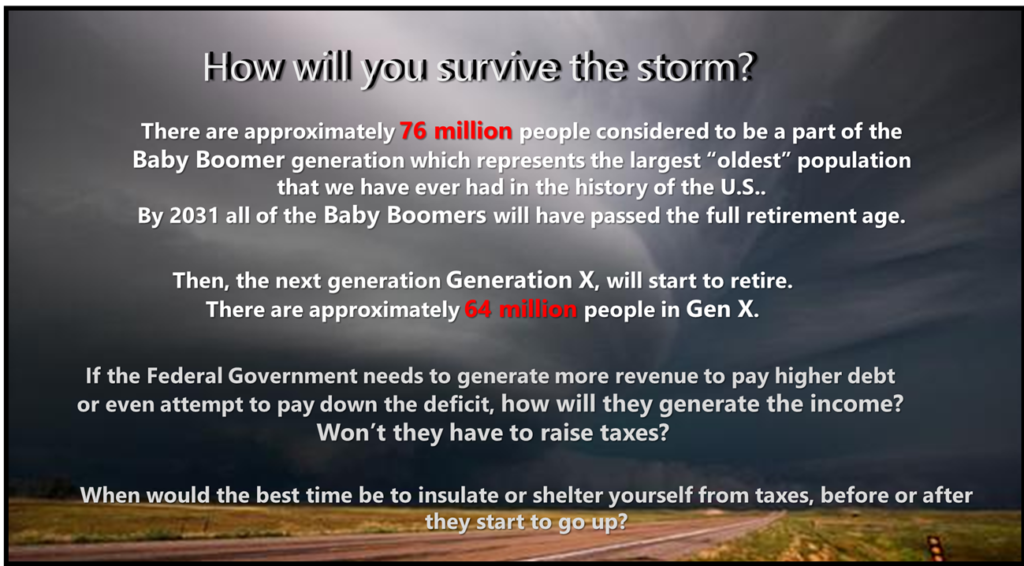

By 2025 Social Security, Medicare, Medicaid, and the interest on the National Debt will consume over 90% of the government’s revenue. Consider how taxes will eventually have to be increased just to keep most American programs solvent.

What are you going to do ?

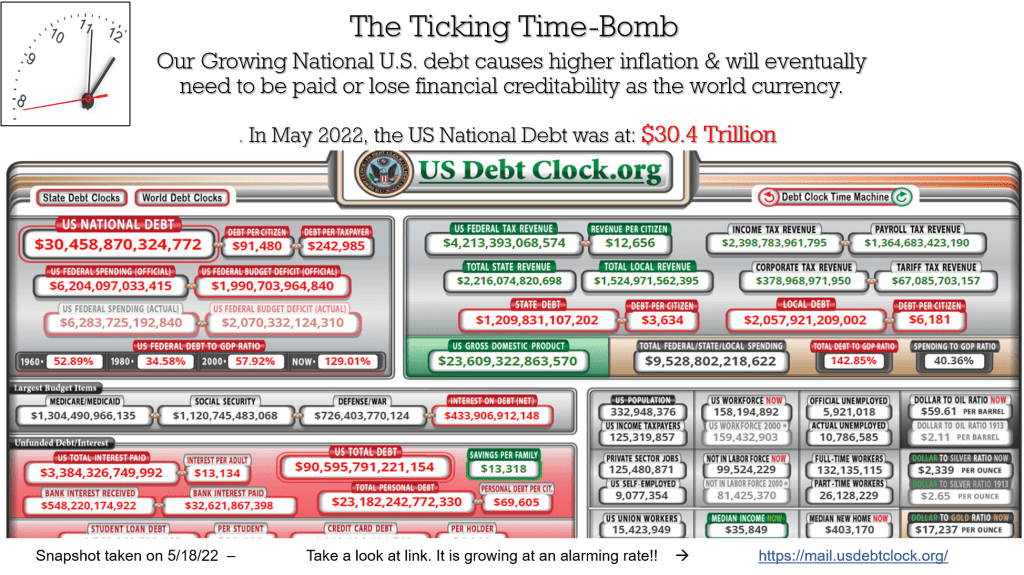

The Ticking, Time-Bomb!

The Simple Truth is that the US Federal government cannot sustain the amount of debt that we are taking on by printing money, overspending, and servicing US Debt.

The question of how long depends on four various economic, fiscal, and political factors:

- Monetary Policy vs. Fiscal Policy: Printing money, also known as monetary policy, is primarily the domain of the Federal Reserve, the central banking system of the United States. The Federal Reserve manages the money supply to achieve objectives such as controlling inflation and stabilizing the economy. Fiscal policy, on the other hand, involves decisions by the government regarding taxation and spending. While the Federal Reserve can create money through mechanisms like quantitative easing, the government’s ability to raise revenue through taxes is a key component of fiscal policy.

- Inflation Concerns: Printing money excessively can lead to inflation if the increase in the money supply outpaces economic growth. While some level of inflation is normal and even desirable for a growing economy, high or hyperinflation can erode purchasing power and destabilize the economy. Therefore, policymakers must balance the need for monetary expansion with the risk of inflation.

- Debt Sustainability: The US Federal government’s ability to sustain debt depends on its capacity to service that debt over time. High levels of debt relative to GDP can lead to concerns about debt sustainability, as the government may struggle to make interest payments and face higher borrowing costs. Raising taxes can be one way to generate revenue to service the debt and prevent further increases.

- Political Considerations: Decisions about monetary policy and taxation are influenced by political dynamics, including the preferences of elected officials, ideological differences, and public opinion. Political leaders must navigate competing priorities and trade-offs when making decisions about fiscal and monetary policy.

What about U.S. Federal Taxation Historically?

The history of federal tax tables and their relationship to the national debt is complex and multifaceted, but here’s a simplified overview:

Early Years (18th-19th Century):

In the early years of the United States, federal taxation was minimal, primarily relying on tariffs, excise taxes, and occasional direct taxes.

The national debt fluctuated significantly, often rising during times of war and falling during periods of peace and economic growth.

Introduction of Federal Income Tax (20th Century):

The modern federal income tax was introduced with the ratification of the 16th Amendment to the United States Constitution in 1913.

Initially, tax rates were relatively low and applied only to high-income earners.

The national debt remained relatively modest compared to later years.

World War I and Interwar Period:

The need to finance World War I led to significant increases in federal income tax rates and expansion of the tax base.

Despite efforts to raise revenue through taxation, the national debt increased substantially due to the costs of the war.

After the war, tax rates were gradually lowered, but the debt remained elevated.

Great Depression and World War II:

The Great Depression prompted the government to raise tax rates and introduce new taxes to address falling revenue and finance relief programs.

World War II further escalated federal spending and debt levels. To fund the war effort, tax rates were raised significantly, and tax brackets were expanded to include more taxpayers.

By the end of World War II, the national debt had reached historic highs relative to GDP.

Post-War Period and Cold War Era:

In the post-war period, tax rates remained relatively high compared to pre-war levels, as the government sought to reduce the debt accumulated during the war.

The Cold War era saw continued high levels of military spending, contributing to fluctuations in the national debt.

Tax policy evolved, with periods of tax cuts and tax reforms aimed at stimulating economic growth and addressing budget deficits.

Late 20th Century to Present:

Tax policy underwent significant changes during this period, including the Tax Reform Act of 1986, which simplified the tax code and lowered tax rates.

The 21st century saw further tax cuts, particularly with the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 under President George W. Bush.

The national debt increased substantially in the early 21st century, driven by factors such as the War on Terror, financial bailouts, and economic stimulus measures.

Tax tables continued to be adjusted over the years, with changes in rates, brackets, deductions, and credits affecting taxpayer liabilities.

Throughout the 20th & 21st century, the relationship between federal tax tables and the national debt has been one of revenue generation and expenditure. Changes in tax policy have been influenced by various factors, including economic conditions, political priorities, and the need to address budgetary challenges, including the national debt.

- The US Federal Debt has generally trended upwards over the past century, with fluctuations influenced by factors such as wars, economic recessions, and government spending policies.

- Major spikes in the debt occurred during periods of war, such as World War I, World War II, and the post-9/11 conflicts.

- The debt has also increased due to economic downturns, financial crises, and government stimulus measures

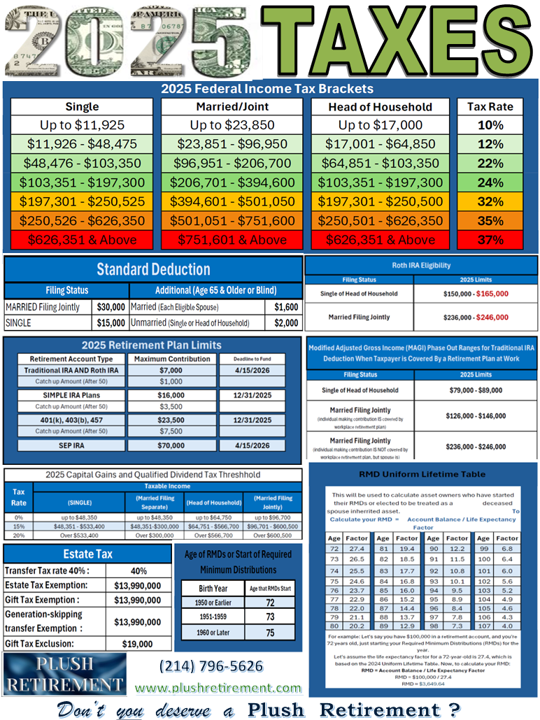

To see what tax brackets have been historically between 1862 and 2021

To see what tax brackets are now:

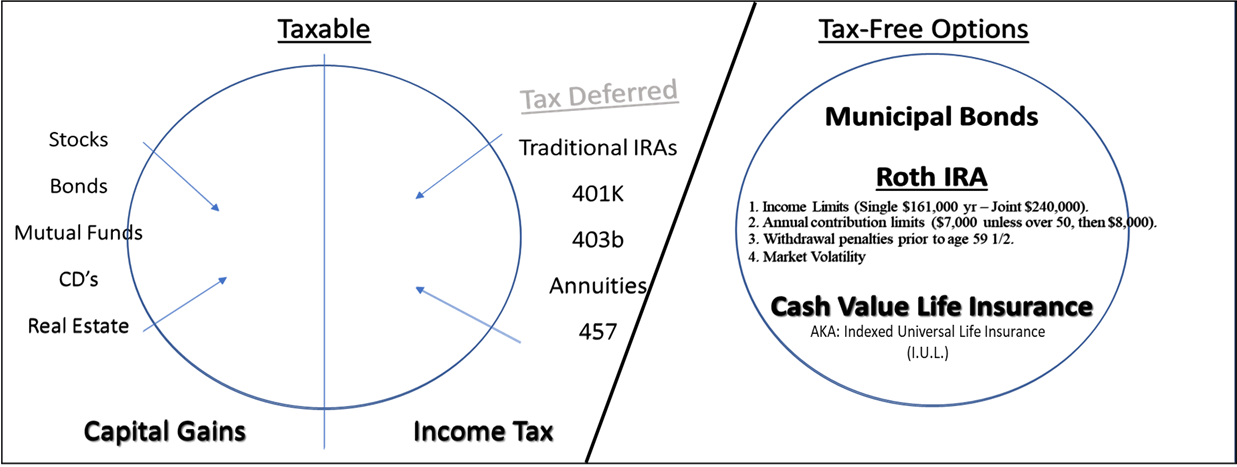

If you’re like most Americans, you’ve saved the majority of your retirement assets in tax-deferred vehicles like 403bs, 457s, 401(k)s, SEPs, TSPs, and Traditional IRAs. But what happens when federal tax rates go up?

How much of your hard-earned money will you really get to keep?

Unless you can accurately predict what tax rates will be when you take those dollars out, do you have any idea how much of that money is really yours?

Are you that much of a fan or the IRS that you want to make them your major beneficiary?

So what’s the solution?

The zero percent tax bracket.

Why?

…… Because if tax rates double, two times zero is still zero!

Get to the ZERO PERCENT Tax Bracket!!

Would You Rather Pay Taxes! On the Seed OR On the Harvest

Advantages of Index Annuities 403b and IRA’s

“The Harvest”

- Tax Deferred Growth. The principal and interest earned are not taxed until withdrawn. Your funds grow tax deferred with triple compounding of interest.

- Safety. Annuities are among the most guaranteed and safe investments available, along with Banks and the U.S. Treasury.

- Guaranteed Lifetime Income. At any time, Annuities can change from a savings or accumulation vehicle to an income vehicle. Annuities can provide an income that cannot be outlived.

- Interest Crediting. Interest is fixed or tied to the upward trend of the major stock indices. You receive the benefits of stock market gains when the market is up, but none of the losses when the market is down. Sleep at night investing.

- Access and Liquidity. Unlike bank CD’s you have access to your funds during the interest earning time period and can withdraw up to 10% of account value per year.

- FEES. No Contract Fees or Sales Commissions.

- Death Benefit. Your beneficiary will always receive the full account value from the annuity Immediately.

Advantages of Index Universal Life Solutions

“The Seed”

Principal Grows Tax Deferred with Tax Free Retirement

Income

Tax Free Death Benefit

No 591/2 or 701/2 Rule – No Government Involvement

➤ Liquidity – Access to Cash Value for Emergencies, Lifestyle, Access to Credit Line.

Predictable Financial Result / Guaranteed Cash

Growth Accumulation.

➤ Strategies that offer 13.5% interest with the SP500 /Plans with 140% Participation with the S&P500

Tax Free College Savings Planancial services, LLC Flexibility of Contributions (Few Limits)

Flexibility of Distributions

➤ Credit Proof- Protected Assets

➤ Living Benefits included at no cost

o Terminal Illness-90% of death benefit

o Critical Illness-lump sum benefit for heart attack, stroke, cancer, organ transplant, blindness, LG, et.

o Chronic Illness -long term care benefit at 2% of death benefit

O Disability Income-pays monthly benefit

➤ Wealth accumulation vehicle-No Volatility, No Taxes

Life Solutions Plan

Example 1

$200 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $8,099

10 years: $23,029

20 years: $72,490

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $102K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

Life Solutions Plan

Example 2

$300 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $12,258

10 years: $34,933

20 years: $109,948

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $157K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

Life Solutions Plan

Example 3

$400 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $16,198

10 years: $46,058

20 years: $144,980

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $157K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

If and when you are ready to develop a strategy that will accumulate sufficient wealth for retirement without the IRS getting in your pocket later, let us help by clicking the link below.

Set up a complimentary appointment at a time convenient for you at this link: