The Rule of 72

What is the rule of 72?

The Rule of 72 is a simple way to estimate how long it may take for your investment to double.

Though not a precise formula, it offers a quick way to gauge where your portfolio could be in the years ahead.

While past performance doesn’t guarantee future results, this rule provides a useful framework for understanding potential growth.

For a more tailored approach, consulting a financial professional is always a wise step.

The Rule of 72 formula

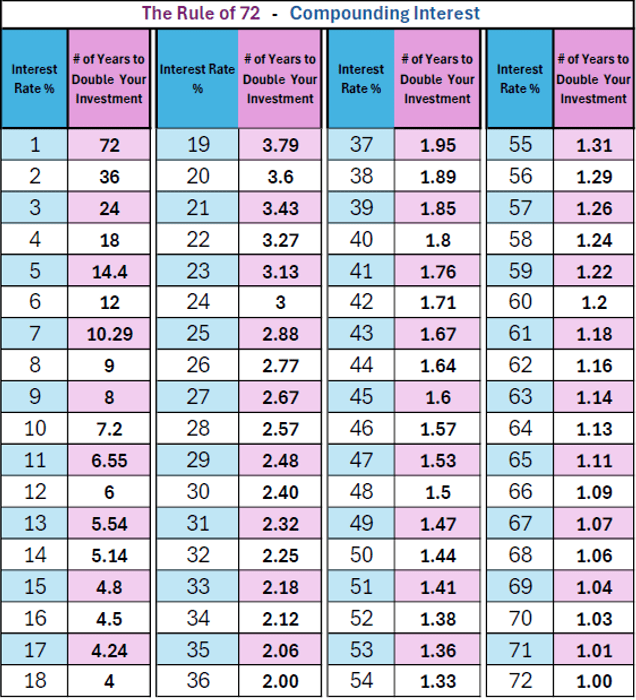

The Rule of 72 is an easy way that you can estimate the number of years it will take for an investment to double by

dividing 72 by the annual rate of return.

For Example

If the annual rate of return is 6%, it would take approximately 12 years for the investment to double (72 ÷ 6 = 12).

If the annual rate of return is 9%, it would take approximately 8 years for the investment to double (72 ÷ 9 = 8).

If the annual rate of return is 12%, it would take approximately 6 years for the investment to double (72 ÷ 12 = 6).

This visual representation helps investors understand the power of compounding Interest and the relationship between time and investment growth.

- The horizontal axis represents time in years.

- The vertical axis represents the value of the investment.

- The diagonal line represents the growth trajectory of the investment value over time.

- The point where the trajectory intersects the dashed line indicates when the investment doubles in value.

The following illustration simplifies how long it will take for each percentage rate to double the original investment.

Important !! If you have a 21% rate on your credit card maintaining a balance, then you will pay DOUBLE the amount borrowed in less than 4 years!!