The "Plush Retirement" Strategy

Tax- Free Retirement Income, No Bank Qualification Documents, Life-Changing, Generational, Wealth Legacy !

Sounds too good to be true???

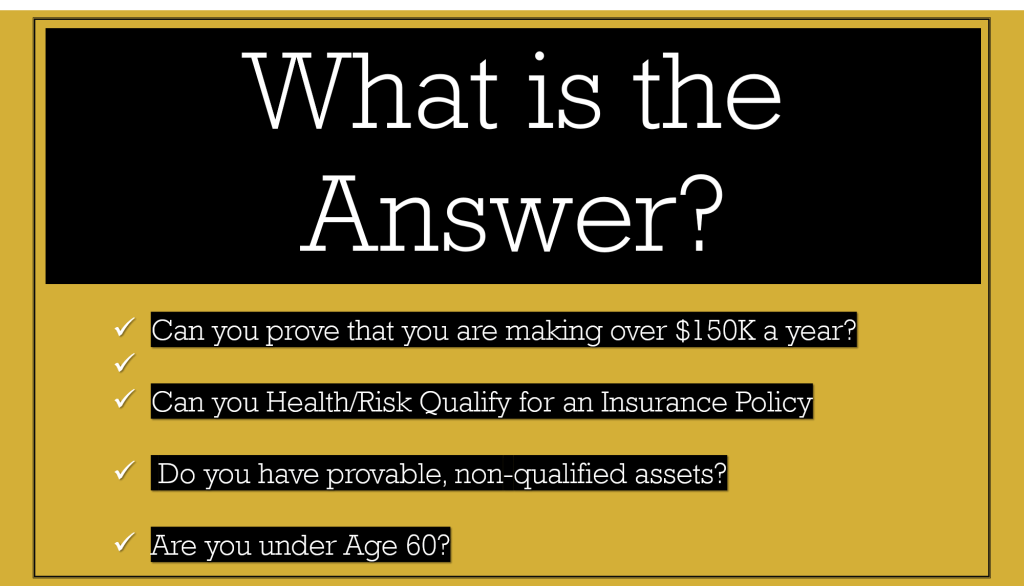

If you think that it's too late to make a significant impact on your retirement, then it’s worth a free consultation with one of our Plush Retirement Specialists.

Introducing Kai-Zen

Your answer to a

Plush Retirement!

Unlock the key to your successful Retirement.

How Kai-Zen Works: https://vimeo.com/370399450

Kai-Zen for Individuals: https://vimeo.com/660980875

Kai-Zen Mortgage Analogy: https://vimeo.com/498407899

Kai-Zen 60 Seconds – Quick Intro (Web view)

More KaiZen Educational Videos (With CEO Daen Wombwell)

Kai-Zen Live! | Today's Financial Worries. "Tomorrow's Revolutionary Solution" with Daen Wombwell

What Rising Interest Rates Mean for Kai-Zen | NIW Live! #2

Difference Between IUL's and Index Funds | NIW Live! Clip

Set up a complimentary appointment at a time convenient for you at this link: Advanced Wealth Strategies (Web view)